All Categories

Featured

Table of Contents

I paid into Social Safety and security for 26 years of significant incomes when I was in the personal sector. I do not desire to return to work to obtain to 30 years of substantial incomes in order to avoid the windfall elimination arrangement decrease.

I am paying all of my costs currently however will certainly do even more traveling as soon as I am gathering Social Protection. I assume I require to live till about 84 to make waiting an excellent option.

If your Social Security benefit is really "enjoyable cash," as opposed to the lifeline it works as for lots of people, maximizing your benefit might not be your leading concern. Get all the details you can about the cost and benefits of declaring at different ages prior to making your choice. Liz Weston, Licensed Financial Organizer, is an individual financing columnist for Questions may be sent to her at 3940 Laurel Canyon Blvd., No.

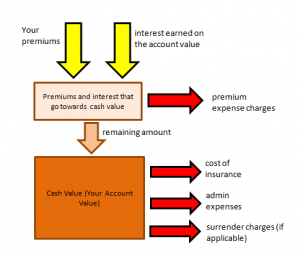

Cash worth can collect and expand tax-deferred inside of your policy. It's vital to keep in mind that impressive plan loans accrue passion and reduce cash worth and the fatality benefit.

If your cash money worth fails to expand, you may need to pay higher costs to maintain the policy in pressure. Plans might use various alternatives for expanding your cash value, so the crediting price depends upon what you select and how those options carry out. A set segment gains rate of interest at a defined rate, which may transform with time with economic problems.

Neither sort of plan is always far better than the other - all of it boils down to your goals and strategy. Entire life policies might appeal to you if you favor predictability. You know specifically just how much you'll need to pay annually, and you can see just how much cash value to anticipate in any type of provided year.

Cost Of Universal Life Insurance Policy

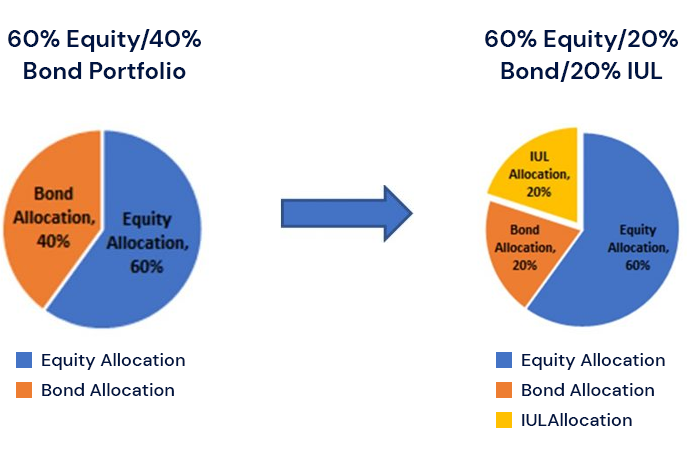

When analyzing life insurance needs, review your long-lasting objectives, your existing and future expenses, and your wish for safety and security. Discuss your objectives with your representative, and choose the policy that works finest for you. * As long as needed premium repayments are prompt made. Indexed Universal Life is not a security investment and is not an investment in the market.

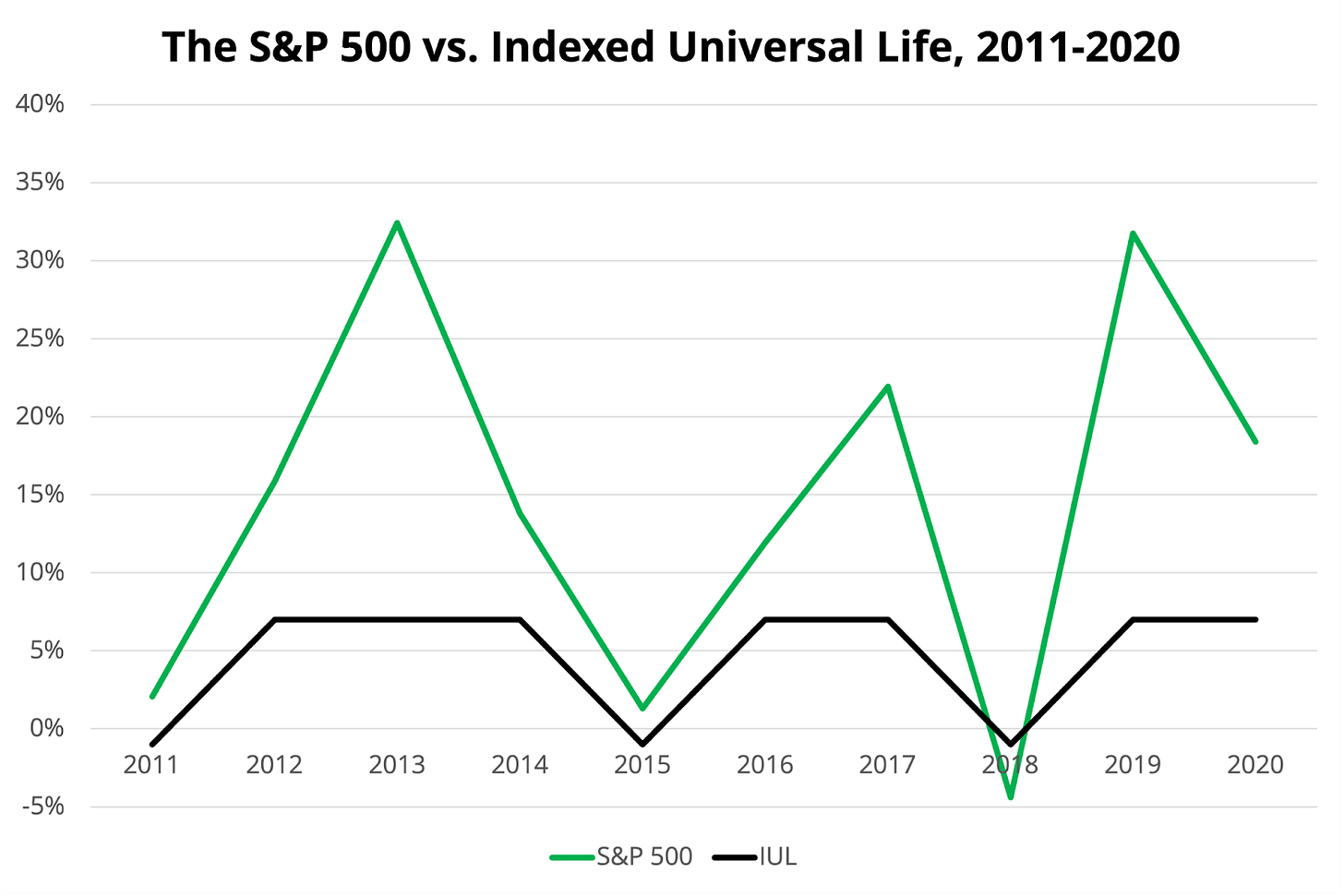

Last year the S&P 500 was up 16%, but the IULs development is capped at 12%. That doesn't sound regrettable. 0% floor, 12% prospective! Why not?! Well, a pair things. These IULs overlook the existence of rewards. They look at just the modification in share price of the S&P 500.

Ul Mutual Life Insurance

Second, this 0%/ 12% game is basically a shop method to make it sound like you always win, however you do not. 21 of those were greater than 12%, balancing almost 22%.

If you require life insurance policy, purchase term, and spend the rest. -Jeremy by means of Instagram.

Your existing internet browser might limit that experience. You might be utilizing an old internet browser that's in need of support, or setups within your browser that are not suitable with our website.

Your present browser: Identifying ...

You will have will certainly provide certain offer about yourself and your lifestyle in order to receive a get universal life insurance quote. Smokers can expect to pay higher costs for life insurance than non-smokers.

Equity Indexed Life

If the plan you're checking out is generally underwritten, you'll need to complete a medical examination. This examination entails conference with a paraprofessional that will certainly obtain a blood and urine sample from you. Both examples will certainly be tested for feasible health threats that could affect the kind of insurance policy you can get.

Some factors to think about include the number of dependents you have, the amount of earnings are coming into your home and if you have expenditures like a mortgage that you would want life insurance policy to cover in case of your death. Indexed universal life insurance coverage is just one of the more complex kinds of life insurance policy currently readily available.

If you're trying to find an easy-to-understand life insurance policy policy, however, this may not be your ideal alternative. Prudential Insurance Company and Voya Financial are several of the greatest suppliers of indexed global life insurance policy. Voya is thought about a top-tier supplier, according to LIMRA's second quarter 2014 Final Premium Coverage. While Prudential is a longstanding, very valued insurance business, having actually been in company for 140 years.

Universal Life Policy Vs Term

On April 2, 2020, "A Vital Testimonial of Indexed Universal Life" was provided through numerous outlets, consisting of Joe Belth's blog site. (Belth's recap of the initial piece can be discovered right here. His follow-up blog site containing this article can be found below.) Not remarkably, that item created considerable comments and objection.

Some disregarded my comments as being "brainwashed" from my time working for Northwestern Mutual as an office actuary from 1995 to 2005 "regular entire lifer" and "biased against" products such as IUL. There is no contesting that I benefited Northwestern Mutual. I appreciated my time there; I hold the firm, its employees, its products, and its mutual approach in prestige; and I'm thankful for all of the lessons I discovered while used there.

I am a fee-only insurance policy advisor, and I have a fiduciary responsibility to look out for the very best rate of interests of my customers. Necessarily, I do not have a bias toward any kind of kind of item, and as a matter of fact if I discover that IUL makes good sense for a customer, after that I have a commitment to not only present but suggest that choice.

I constantly strive to place the most effective foot onward for my customers, which suggests using styles that lessen or get rid of payment to the best level possible within that specific policy/product. That doesn't always indicate advising the policy with the least expensive compensation as insurance is even more difficult than merely comparing payment (and in some cases with items like term or Assured Universal Life there merely is no commission flexibility).

Some suggested that my degree of enthusiasm was clouding my reasoning. I love the life insurance industry or at the very least what it can and ought to be (north american universal life insurance). And yes, I have an unbelievable amount of interest when it pertains to wishing that the market does not obtain yet one more shiner with excessively hopeful illustrations that established customers up for frustration or worse

Indexed Death Benefit

And currently history is repeating itself as soon as again with IUL. Over-promise currently and under-deliver later. The more things transform, the more they stay the very same. I may not have the ability to alter or save the market from itself relative to IUL products, and honestly that's not my objective. I desire to assist my clients take full advantage of value and stay clear of critical mistakes and there are customers around each day making poor decisions with regard to life insurance coverage and specifically IUL.

Some individuals misunderstood my criticism of IUL as a blanket recommendation of all points non-IUL. This could not be even more from the truth. I would certainly not directly recommend the substantial majority of life insurance policy plans in the market for my customers, and it is rare to locate an existing UL or WL plan (or proposal) where the visibility of a fee-only insurance advisor would not include substantial client worth.

Table of Contents

Latest Posts

Indexed Death Benefit

Universal Life Insurance Rates

Allianz Iul

More

Latest Posts

Indexed Death Benefit

Universal Life Insurance Rates

Allianz Iul